Understanding the Lauderdale County Tax Map: A Comprehensive Guide

Related Articles: Understanding the Lauderdale County Tax Map: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding the Lauderdale County Tax Map: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Lauderdale County Tax Map: A Comprehensive Guide

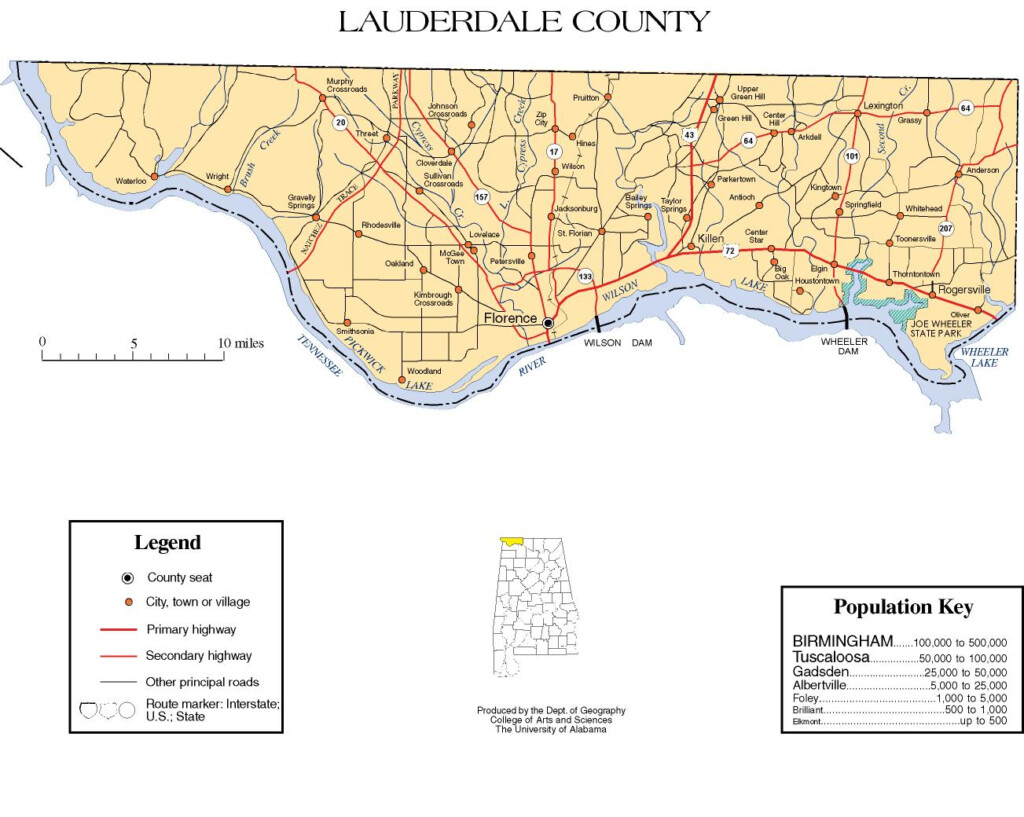

Lauderdale County, like many other jurisdictions, utilizes a tax map as a fundamental tool for property administration and taxation. This comprehensive document serves as a visual representation of the county’s real estate holdings, providing valuable information for property owners, taxpayers, and government officials alike.

Delving into the Details:

The Lauderdale County tax map is a meticulously crafted document that encompasses a wide range of data, including:

- Property Boundaries: The map clearly delineates the boundaries of each individual property within the county, ensuring accurate identification and measurement.

- Property Identification Numbers (PINs): Each property is assigned a unique PIN, acting as a primary identifier for all related tax and property records.

- Property Classification: The map categorizes properties based on their usage, such as residential, commercial, agricultural, or industrial, aiding in the application of appropriate tax rates.

- Property Values: Assessed values, reflecting the estimated market value of each property, are displayed on the map, forming the basis for tax calculations.

- Tax Information: The map may also include details regarding tax rates, payment deadlines, and other relevant tax-related information.

- Infrastructure and Utilities: Features like roads, waterways, and utility lines are often incorporated into the map, providing a holistic understanding of the county’s infrastructure.

Importance and Benefits:

The Lauderdale County tax map plays a vital role in various aspects of county operations and serves as a valuable resource for numerous stakeholders:

For Property Owners:

- Clear Property Identification: The map helps property owners understand the exact boundaries of their land, preventing potential disputes with neighbors.

- Accurate Tax Calculations: The assessed values displayed on the map ensure accurate tax calculations, allowing property owners to make informed financial decisions.

- Property Management: The map serves as a valuable reference tool for property management purposes, enabling owners to track changes in ownership, improvements, or other relevant details.

For Taxpayers:

- Transparency and Accountability: The tax map provides a transparent and accessible overview of the county’s property tax system, fostering trust and accountability.

- Understanding Tax Burdens: The map helps taxpayers understand the distribution of tax burdens across different property types and locations.

- Identifying Potential Tax Issues: By comparing their property information on the map with their tax records, taxpayers can identify any potential discrepancies or errors.

For Government Officials:

- Effective Tax Administration: The map is essential for administering the county’s tax system efficiently and equitably.

- Land Use Planning: The map provides valuable data for land use planning, enabling the county to make informed decisions regarding zoning, development, and infrastructure projects.

- Economic Development: The map helps identify potential areas for economic growth and development, fostering investment and job creation.

FAQs Regarding the Lauderdale County Tax Map:

Q: How can I access the Lauderdale County tax map?

A: The map is typically available online through the county’s official website or through dedicated property information platforms. Contact the Lauderdale County Tax Assessor’s office for specific instructions.

Q: Can I view the map for a specific property?

A: Yes, most online maps allow you to search by property address, PIN, or other relevant criteria.

Q: How often is the tax map updated?

A: The map is typically updated annually to reflect changes in property ownership, values, or other relevant data.

Q: What if I find an error on the tax map?

A: Contact the Lauderdale County Tax Assessor’s office to report any inaccuracies or discrepancies.

Tips for Utilizing the Lauderdale County Tax Map:

- Familiarize yourself with the map’s legend: Understanding the symbols and abbreviations used on the map is essential for accurate interpretation.

- Use the search functions: Utilize the map’s search functions to quickly locate specific properties or areas of interest.

- Compare map data with your tax records: Verify that the information on the map aligns with your property tax records.

- Contact the Tax Assessor’s office for assistance: If you have any questions or require further clarification, reach out to the Lauderdale County Tax Assessor’s office for support.

Conclusion:

The Lauderdale County tax map serves as a vital resource for property owners, taxpayers, and government officials alike. Its comprehensive nature provides valuable information for property administration, tax calculations, land use planning, and economic development. By understanding the map’s features and benefits, individuals and organizations can leverage its information to make informed decisions and navigate the complexities of property ownership and taxation within Lauderdale County.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Lauderdale County Tax Map: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!