Navigating the New Markets Tax Credit Map: A Guide to Investment in Underserved Communities

Related Articles: Navigating the New Markets Tax Credit Map: A Guide to Investment in Underserved Communities

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the New Markets Tax Credit Map: A Guide to Investment in Underserved Communities. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the New Markets Tax Credit Map: A Guide to Investment in Underserved Communities

The New Markets Tax Credit (NMTC) program, established by the Community Renewal Tax Relief Act of 2000, provides a powerful tool for attracting private investment to distressed communities. This program incentivizes the development of businesses and affordable housing in low-income areas by offering tax credits to investors who contribute to projects within designated census tracts. Understanding the NMTC map, which outlines these designated areas, is crucial for investors seeking to make a social impact while generating returns.

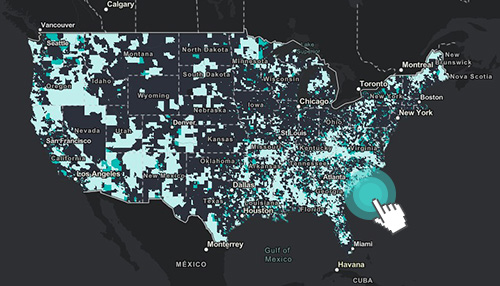

Defining the NMTC Map:

The NMTC map is a visual representation of census tracts eligible for NMTC funding. These tracts are classified as "low-income communities" based on specific criteria, including poverty rate, unemployment rate, and median family income. The map is updated annually by the U.S. Treasury Department, reflecting changes in economic conditions and demographics.

Understanding the Program’s Impact:

The NMTC program plays a vital role in revitalizing distressed communities by:

- Attracting Private Investment: The tax credit incentivizes private investors to allocate capital to projects that might otherwise be considered too risky.

- Creating Jobs: NMTC-funded projects often lead to the creation of new jobs, boosting local economies and providing employment opportunities for residents.

- Stimulating Economic Growth: By fostering business development and housing affordability, the program contributes to overall economic growth in underserved communities.

- Improving Quality of Life: NMTC projects can improve access to healthcare, education, and other essential services, enhancing the quality of life for residents.

Navigating the NMTC Map: Key Considerations:

Investors interested in utilizing the NMTC program must carefully consider the following:

- Geographic Targeting: The NMTC map outlines eligible areas, but investors must conduct thorough due diligence to identify specific projects that align with their investment goals and risk tolerance.

- Project Feasibility: Projects must demonstrate viability and a strong potential for success to attract investors.

- Community Engagement: Effective collaboration with local communities is essential for project success and ensures that projects address local needs and priorities.

- Compliance Requirements: Investors must adhere to strict compliance regulations and reporting requirements associated with the NMTC program.

The Role of Community Development Entities (CDEs):

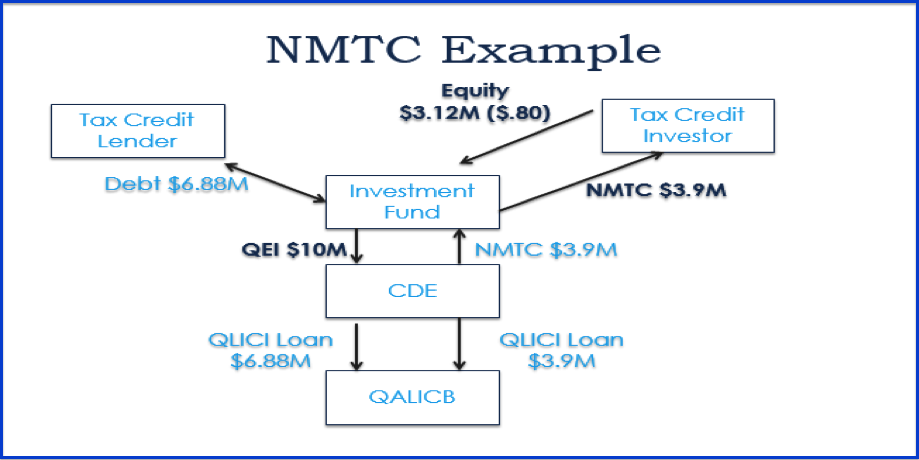

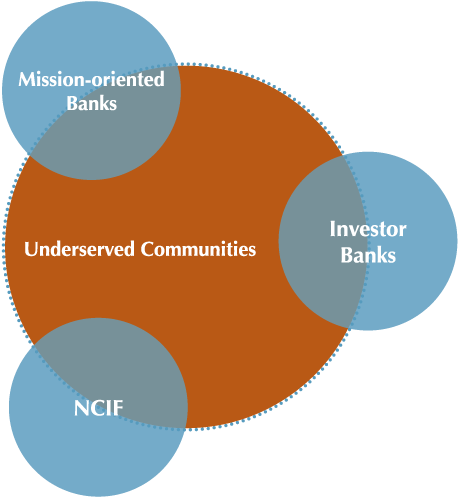

CDEs are non-profit organizations that play a crucial role in the NMTC program. They act as intermediaries between investors and projects, providing expertise in project development, community outreach, and compliance management. CDEs receive NMTC allocations from the Treasury Department and allocate them to projects within their designated service areas.

The NMTC Map: A Tool for Social Impact and Financial Returns:

The NMTC map provides investors with a roadmap for making impactful investments that contribute to the economic and social well-being of underserved communities. By understanding the program’s structure, geographic targeting, and compliance requirements, investors can navigate the NMTC landscape effectively and align their investments with their social impact objectives.

Frequently Asked Questions (FAQs) about the NMTC Map:

Q: What are the criteria for designating a census tract as "low-income?"

A: The Treasury Department uses a combination of factors, including poverty rate, unemployment rate, and median family income, to determine eligibility for NMTC funding. The specific criteria are outlined in the program regulations.

Q: How often is the NMTC map updated?

A: The NMTC map is updated annually by the Treasury Department, reflecting changes in economic conditions and demographics.

Q: How do I identify specific projects within the designated census tracts?

A: You can work with Community Development Entities (CDEs) who have expertise in identifying and developing projects within their designated service areas.

Q: What are the tax benefits of investing in NMTC projects?

A: Investors receive tax credits over a period of seven years, reducing their tax liability and generating a return on investment.

Q: What are the compliance requirements for NMTC projects?

A: Projects must meet specific requirements related to job creation, investment in low-income communities, and reporting. These requirements are outlined in the NMTC program regulations.

Tips for Utilizing the NMTC Map for Impactful Investments:

- Partner with CDEs: CDEs have extensive experience in developing and managing NMTC projects, providing valuable expertise and guidance.

- Conduct Thorough Due Diligence: Carefully evaluate projects to ensure their viability, alignment with your investment goals, and potential for social impact.

- Engage with the Community: Collaborate with local residents and stakeholders to ensure that projects address local needs and priorities.

- Stay Informed about Program Regulations: Keep up-to-date on the latest NMTC program regulations and compliance requirements.

Conclusion:

The NMTC map serves as a vital tool for investors seeking to make impactful investments in underserved communities. By understanding the program’s structure, eligibility criteria, and compliance requirements, investors can leverage the NMTC program to generate financial returns while contributing to economic development and social progress in distressed areas. As the NMTC program continues to evolve, its impact on revitalizing low-income communities will continue to grow, making the NMTC map an essential resource for investors seeking to align their investments with their social impact goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the New Markets Tax Credit Map: A Guide to Investment in Underserved Communities. We hope you find this article informative and beneficial. See you in our next article!